Use these links to rapidly review the documentTABLE OF CONTENTSTable of ContentsContents:Executive Compensation

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

| PRINCIPAL FINANCIAL GROUP, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | | No fee required. | ||

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| | (1) | | Title of each class of securities to which transaction applies: | |

| | (2) | | Aggregate number of securities to which transaction applies: | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | (4) | | Proposed maximum aggregate value of transaction: | |

| | (5) | | Total fee paid: | |

o | | Fee paid previously with preliminary materials. | ||

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | | Amount Previously Paid: | |

| | (2) | | Form, Schedule or Registration Statement No.: | |

| | (3) | | Filing Party: | |

| | (4) | | Date Filed: | |

April 10, 2013Notice of 2016 Annual Meeting

of Shareholders and Proxy Statement

Dear Shareholder:Fellow Shareholders:

You are cordially invited to attend the annual meeting of shareholders on Tuesday, May 21, 2013,17, 2016, at 9:00 a.m., Central Daylight Time, at 711 High750 Park Street, Des Moines, Iowa.

As you can see, we have some exciting news to share. We have a new look:

| | is now | |  |

We're the same company. Only with a bold new global identity to better represent who we are—a partner in financial progress, committed to helping people around the world live their best lives.

The notice of annual meeting and proxy statement provide an outline of the business to be conducted at the meeting. IWe will also report on the progress of the Company, duringshare an update on the past yearrollout of our new brand expression, and answer shareholder questions.

We had a significant change in leadership of the Company in 2015, with Larry Zimpleman transitioning to Chairman, and Daniel Houston taking on the role of Chief Executive Officer as a part of our planned leadership succession. More change will come following the annual meeting when Mr. Houston takes over as Chairman and Mr. Zimpleman leaves the Board having completed his last term.

We also went through an exciting initiative to redefine the Principal® brand. We continue to improve on providing a quality customer experience, simplifying our value proposition, and being a great place to do business and a successful global organization.

We encourage you to read this proxy statement and vote your shares. You do not need to attend the annual meeting to vote. You may complete, date and sign a proxy or voting instruction card and return it in the envelope provided (if these materials were received by mail) or vote by using the telephone or the Internet. Thank you for acting promptly.

Distribution of annual meeting materials

As we've done in the past, The Principal is taking advantage of the Securities and Exchange Commission's rule that allows companies to furnish proxy materials for the annual meeting via the Internet to registered shareholders. For each shareholder selecting to receive these materials electronically in the future, the Principal Financial Group and the Arbor Day Foundation will plant the same number of trees in a U.S. forest. In 2012, 1,8702015, 1,116 trees were planted.

Sincerely,

Larry D. Zimpleman

Chairman

Sincerely,

Daniel J. Houston

President and Chief Executive Officer

April 7, 2016

Notice of Annual Meeting of Shareholders

| Meeting Date: | | |

Time: | |  |

| Location: | |

PRINCIPAL FINANCIAL GROUP, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 21, 2013

The annual meeting of shareholders of Principal Financial Group, Inc. (the "Company"("Company" or "Principal") will be held at 711 High750 Park Street, Des Moines, Iowa, on Tuesday, May 21, 2013,17, 2016 at 9:00 a.m., Central Daylight Time. Matters to be voted on are:The agenda is:

These items are fully described in the proxy statement, which is part of this notice. The Company has not received notice of other matters that may be properly presented at the annual meeting.

ShareholdersYou can vote if you were a shareholder of record at the close of business on March 25, 2013, are entitled to vote at the meeting.22, 2016. It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting, please vote in onevote:

| Internet | | Telephone | | |

| | | | ||

| Through the Internet:visit the website noted in the notice of Internet availability of proxy materials shareholders received by mail, on the proxy or voting instruction card, or in the instructions in the email message that notified you of the availability of the proxy materials. | | By telephone:call the toll free telephone number shown on the proxy or voting instruction card or the instructions in the email message that notified you of the availability of the proxy materials. | | Complete, sign and promptly return a proxy or voting instruction cardin the postage paid envelope provided. |

If you attend the following ways:

Shareholders will need to register at the meeting and present a valid, government issued photo identification to attend the meeting.identification. If your shares are not registered in your name (for example, you hold the shares through an account with your stockbroker), you will need to bring proof of your ownership of those shares to the meeting in order to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or a letter that shows your ownership of Principal Financial Group, Inc. common stock on March 25, 2013.22, 2016. Please bring that documentation to the meeting to register.

By Order of the Board of Directors

Karen E. Shaff

Executive Vice President, General Counsel and Secretary

April 7, 2016

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 17, 2016:

The 2015 Annual Report, 2016 Proxy Statement and other proxy materials are available at

www.principal.com.

Your vote is important! Please take a moment to vote by Internet, telephone or proxy card as explained in the How Do I Vote sections of this document.

TABLE OF CONTENTS Table of Contents

| | | |

Notice of Annual Meeting of Shareholders | | |

Table of | | |

Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates and Diversity of the Board | | 4 |

| | | |

Proposal | | |

| | | |

Corporate Governance | | |

Board Leadership Structure | | |

Role of the Board of Directors in Risk Oversight | | |

Succession Planning and Talent Development | | 12 |

Majority Voting | | |

Director Independence | | |

Certain Relationships and Related Party Transactions | | |

Board Meetings | | |

Corporate Code of Business Conduct and Ethics | | |

Board Committees | | |

| | | |

| | |

| ||

Fees Earned by Directors in | | |

Deferral of Cash Compensation | | |

Restricted Stock Unit Grants | | |

| ||

Directors' Stock Ownership Guidelines | | |

Audit Committee Report | | 19 |

| | | |

Executive Compensation | | |

Compensation Discussion and Analysis | | |

2015 Company Highlights | | 22 |

2015 Compensation Highlights | | 22 |

Compensation Program Philosophy and Policies | | 23 |

Summary of Compensation Elements | | 24 |

How we Make Compensation Decisions | | 25 |

2015 Executive Compensation Decisions | | 27 |

Base Salary | | 28 |

Annual Incentive Pay | | 28 |

Long Term Incentive Compensation | | 31 |

Timing of Stock Option Awards and Other Equity Incentives | | 32 |

Benefits | | 33 |

Change of Control and Separation Pay | | 33 |

Perquisites | | 34 |

Stock Ownership Guidelines | | 34 |

Claw Back Policy | | 34 |

Trading Policy | | 34 |

Succession Planning | | 35 |

Human Resources Committee Report | | 35 |

Risk Assessment of Employee Incentive Plans | | 35 |

Summary Compensation Table | | |

Grants of | |

| 22016 Proxy Statement | | |

Outstanding Equity Awards at Fiscal Year End December 31, | | ||

Option Exercises and Stock Vesting | | ||

Pension Plan Information | | ||

Pension Distributions | | 43 | |

Pension Benefits | | ||

| | ||

Qualified 401(k) Plan and Excess Plan | | 44 | |

| | | | |

Payments Upon Termination | | ||

Employment Agreement | | ||

Severance Plans | | ||

Change of Control Employment Agreements | | ||

Potential Payments Upon a Termination Related to a Change of Control | | ||

| | | | |

Proposal | | ||

| | | | |

Proposal | | ||

Audit Fees | | ||

Audit Related Fees | | ||

Tax Fees | | ||

All Other Fees | | ||

| | | | |

Security Ownership of Certain Beneficial Owners and Management | | ||

Section 16(a) Beneficial Ownership Reporting Compliance | | ||

| | | | |

Questions and Answers About the Annual | | ||

| | | | |

Appendix | | ||

Appendix B Non GAAP Financial Measures | | B-1 |

PROXY STATEMENT

PRINCIPAL FINANCIAL GROUP, INC.711 HIGH STREETDES MOINES, IOWA 50392-0100

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| | | 2016 Proxy Statement3 |

Why didn't I receive a copy of the paper proxy materials?

The Securities and Exchange Commission ("SEC") rules allow companies to deliver a notice of Internet availability of proxy materials to shareholders and provide Internet access to those proxy materials. Shareholders may obtain paper copies of the proxy materials free of charge by following the instructions provided in the notice of Internet availability of proxy materials.

Why did I receive notice of and access to this proxy statement?

The Board of Directors ("Board") of Principal Financial Group, Inc. ("Company") is soliciting proxies to be voted at the annual meeting of shareholders to be held on May 21, 2013, at 9:00 a.m., Central Daylight Time, at 711 High Street, Des Moines, Iowa, and at any adjournment or postponement of the meeting ("Annual Meeting"). When the Board asks for your proxy, it must send or provide you access to proxy materials that contain information required by law. These materials were first made available, sent or given to shareholders on April 10, 2013.

What is a proxy?

It is your legal designation of another person to vote the stock you own. The other person is called a proxy. When you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. The Company has designated three of the Company's officers to act as proxies for the 2013 Annual Meeting: Joyce N. Hoffman, Senior Vice President and Corporate Secretary; Terrance J. Lillis, Senior Vice President and Chief Financial Officer; and Karen E. Shaff, Executive Vice President and General Counsel.

What will the shareholders vote on at the Annual Meeting?

Will there be any other items of business on the agenda?

The Company does not expect any other items of business because the deadline for shareholder proposals and nominations has passed. However, if any other matter should properly come before the meeting, the people authorized by proxy will vote according to their best judgment.

Who can vote at the Annual Meeting?

Shareholders as of the close of business on March 25, 2013 ("Record Date") can vote at the Annual Meeting.

How many votes do I have?

You will have one vote for every share of Company common stock ("Common Stock") you owned on the Record Date.

What constitutes a quorum?

One-third of the outstanding shares of Common Stock as of the Record Date. On the Record Date, there were 293,496,776 shares of Common Stock outstanding. A quorum must be present, in person or by proxy, before any action can be taken at the Annual Meeting, except an action to adjourn the meeting.

How many votes are required for the approval of each item?

What are Broker Non-votes?

If your shares are held in a brokerage account, your broker will ask you how you want your shares to be voted. If you give your broker directions, your shares will be voted as you direct. If you do not give directions, the broker may vote your shares on routine items of business, but not on non-routine items. Proxies that are returned by brokers because they did not receive directions on how to vote on non-routine items are called "broker non-votes."

How do I vote by proxy?

Shareholders of record may vote by mail, by telephone or through the Internet. Shareholders may vote "for," "against" or "abstain" from voting for each of the Director nominees, the proposal on the annual election of Directors, the advisory vote to approve executive compensation and the proposal to ratify the appointment of the independent auditors.

How do I vote shares that are held by my broker?

If you own shares held by a broker, you may direct your broker or other nominee to vote your shares by following the instructions that your broker provides to you. Most brokers offer voting by mail, telephone and through the Internet.

How do I vote in person?

If you are going to attend the Annual Meeting, you may vote your shares in person. However, we encourage you to vote in advance of the meeting by mail, telephone or through the Internet even if you plan to attend the meeting.

How do I vote my shares held in the Company's 401(k) plan?

The trustees of the plan will vote your shares in accordance with the directions you provide by voting on the voting instruction card or the instructions in the email message that notified you of the availability of the proxy materials. Shares for which voting instructions are not received are voted in the discretion of the trustees.

How are shares held in the Demutualization separate account voted?

The Company became a public company on October 26, 2001, when Principal Mutual Holding Company converted from a mutual insurance holding company to a stock company (the "Demutualization") and the initial public offering of shares of the Company's Common Stock was completed. The Company issued Common Stock to Principal Life Insurance Company ("Principal Life"), and Principal Life allocated this Common Stock to a separate account that was established to fund policy credits received as Demutualization compensation by certain employee benefit plans that owned group annuity contracts. Although Principal Life will vote these shares, the plans give Principal Life voting directions. A plan may give voting directions by following the instructions on the voting instruction card or the instructions in the message that notified you of the availability of proxy materials. Principal Life will vote the shares as to which it received no direction in the same manner, proportionally, as the shares in the Demutualization separate account for which it has received instructions.

Who counts the votes?

Votes will be counted by Computershare Trust Company, N.A.

What happens if I do not vote on an issue when returning my proxy?

If no specific instructions are given, proxies that are signed and returned will be voted as the Board of Directors recommends: "For" the election of all Director nominees, "For" the proposal on the annual election of Directors, "For" approval of the Company's executive compensation and "For" the ratification of Ernst & Young LLP as independent auditors.

How do I revoke my proxy?

If you hold your shares in street name, you must follow the instructions of your broker or bank to revoke your voting instructions. Otherwise, you can revoke your proxy or voting instructions by voting a new proxy or instruction card or by voting at the meeting.

What should I do if I want to attend the Annual Meeting?

Please bring photo identification and, if your stock is held by a broker or bank, evidence of your ownership of Common Stock as of March 25, 2013. The notice of Internet availability of proxy materials you received in the mail, a letter from your broker or bank or a photocopy of a current account statement will be accepted as evidence of ownership.

How do I contact the Board?

The Company has a process for shareholders and all other interested parties to send communications to the Board through the Presiding Director. You may contact the Presiding Director of the Board through the Investor Relations section of the Company's website atwww.principal.com, or by writing to:

Presiding Director, c/o Joyce N. Hoffman, Senior Vice President and Corporate SecretaryPrincipal Financial Group, Inc.Des Moines, Iowa 50392-0300

All emails and letters received will be categorized and processed by the Corporate Secretary and then sent to the Company's Presiding Director.

How do I submit a shareholder proposal for the 2014 Annual Meeting?

The Company's next annual meeting is scheduled for May 20, 2014. Proposals should be sent to the Corporate Secretary. Proposals to be considered for inclusion in next year's proxy statement must be received by December 11, 2013. In addition, the Company's By-Laws provide that any shareholder wishing to propose any other business at the annual meeting must give the Company written notice between January 21, 2014 and February 24, 2014. That notice must provide other information as described in the Company's By-Laws, which are on the Company's website,www.principal.com.

What is "householding?"

We send shareholders of record at the same address one copy of the proxy materials unless we receive instructions from a shareholder requesting receipt of separate copies of these materials.

If you share the same address as multiple shareholders and would like the Company to send only one copy of future proxy materials, please contact Computershare Trust Company, N.A. at 866-781-1368, or P.O. Box 43078, Providence, RI 02940-3078. You can also contact Computershare to receive individual copies of all documents.

Where can I receive more information about the Company?

We file reports and other information with the SEC. This information is available on the Company's website atwww.principal.com and at the Internet site maintained by the SEC atwww.sec.gov. You may also contact the SEC at 1-800-SEC-0330. The Audit, Finance, Human Resources and Nominating and Governance Committee charters, the Company's Corporate Governance Guidelines, and the Corporate Code of Business Conduct and Ethics are also available on the Company's website,www.principal.com.

The Board urges you to exercise your right to vote by using the Internet or telephone or by returning the proxy or voting instruction card.

Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates and Diversity of the Board

The Nominating and Governance Committee regularly assesses the expertise, skills, backgrounds, competencies and other characteristics of Directors and candidates for Board vacancies in light of the current Board makeup and the Company's strategic initiatives, risk factors, and other relevant circumstances, such as a candidate's current employment responsibilities. The Committee also assesses personal and professional ethics, integrity, values and ability to contribute to the Board. The Board values experience as a current or former CEO or other senior executive in financial services, in international business and with financial management or accounting responsibilities. The following competencies are also particularly valued: strategic orientation, results orientation and comprehensive decision making, risk management and an understanding of current technology issues. The Committee periodically uses an outside consultant to assist with this responsibility, and these assessments provide direction in searches for Board candidates and in the evaluation of current Directors for nomination. The Committee reviews the performance of Directors whose terms are expiring as part of the determination of whether to recommend their nomination for reelection to the Board. Input is also received from the other Directors and an outside consultant may be engaged to assist with these reviews. Director performance and capabilities are evaluated against the characteristics noted above. Following the Committee's discussion, the outside consultant (or the Committee Chair) provides feedback to the Directors who were evaluated. The Board annually conducts a self-evaluation regarding its effectiveness, and the Audit, Finance, Human Resources and Nominating and Governance Committees also annually evaluate their respective committee's performance.

All Board members have:

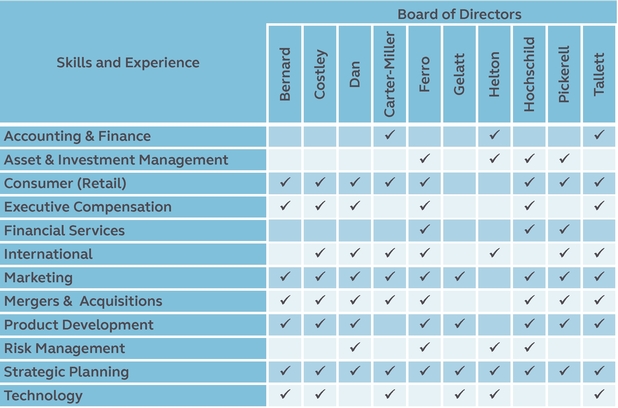

Several current independent Directors have led businesses or major business divisions as CEO or President (Ms. Bernard, Dr. Costley, Mr. Dan, Mr. Ferro, Dr. Gelatt, Mr. Hochschild, Mr. Pickerell and Ms. Tallett). The following chart shows areas central to the Company's strategy, initiatives and operations for which independent Directors have specific training and executive level experience that assists them in their responsibilities.

Though the Board does not have a formal diversity policy, diversity of the Board is a valued objective. Therefore, the Nominating and Governance Committee reviews the Board's needs and diversity in terms of race, gender, national origin, backgrounds, experiences and areas of expertise when recruiting new Directors. Forty percent of the Company's independent Directors are women. The Board's diversity objective reflects the values of the Company as

| 42016 Proxy Statement | | |

well. Principal has been recognized as one of the National Association of Female Executives' Top Companies for Executive Women for 13 consecutive years; received top marks from the Human Rights Campaign Foundation's 2016 Corporate Equality Index; and was named one of the 25 most influential companies for veteran hiring by Diversity Journal in 2015. We also were named one of the Ethisphere Institute World's Most Ethical Companies, Forbes America's Best Employers, and Working Mother magazine's 100 Best Companies. The Board's effectiveness benefits from Directors who have the skills, backgrounds and qualifications needed by the Board and who also increase the Board's diversity.

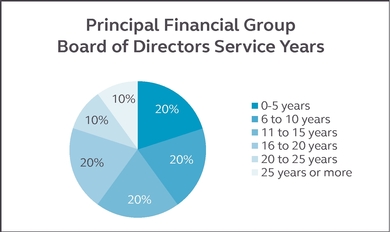

The Board believes that its thorough Director performance reviews and healthy Board refreshment processes better serve Principal and its stakeholders than would mandatory term limits. Strict term limits would require that Principal lose the continuing contribution of Directors who have invaluable insight into Principal and its industry, strategies and operations as a result of their experience. Directors' terms must not extend past the annual meeting following their 72nd birthday. The tenure of the independent Directors is listed below. The average tenure of Principal's independent Directors is 13.2 years.

Two new independent Directors were added to the Board in 2015: Roger C. Hochschild and Blair C. Pickerell. Mr. Hochschild has executive level experience in asset and investment management, retail consumer services, executive compensation, financial services, marketing, mergers & acquisitions, product development, risk management and strategic planning. Mr. Pickerell has extensive experience with the asset and investment management and financial services industries as well as considerable international expertise. Both additions were the result of a lengthy search that included consideration of numerous highly qualified director candidates. The search was led by the Nominating and Governance Committee, with the assistance of a search firm. Director candidates met with Betsy J. Bernard, Chair of the Nominating and Governance Committee, Lead Director Elizabeth Tallett, Mr. Zimpleman (then Chairman and CEO) and other members of senior management. The Nominating and Governance Committee is in the process of identifying a replacement for Dr. Costley, who has reached the Board's retirement age. We anticipate that three additional tenured Directors will be replaced over the next six years, continuing our process of regularly refreshing the talents and perspectives reflected on our Board. The tenure of the Directors, as reflected in the chart above, balances deep knowledge of the Company, its industry and relevant issues, with fresh perspectives and additional expertise, while providing the oversight and independence needed to meet the interests of our shareholders.

Communicating with stakeholders including clients, customers, employees, and investors, has always been an important part of how Principal conducts its business. Principal has had in place for some time a formal engagement process with shareholders around matters of corporate governance. This past year, with the Board's Lead Director, we met in person with holders of a significant percentage of the Company's outstanding Common Stock and had robust discussions regarding our core corporate governance policies. These discussions provided us with helpful insight into shareholders' views on current governance topics, which were reported to the Nominating and Governance Committee and the full Board. This process, and past engagement efforts, regularly supplement relevant communications regarding corporate governance made through the Company's website and by the Investor Relations staff.

The Nominating and Governance Committee will consider shareholder recommendations for Director candidates sent to it c/o the Company Secretary. Director candidates nominated by shareholders are evaluated in the same manner as Director candidates identified by the Committee and search firms it retains.

| | | 2016 Proxy Statement5 |

PROPOSAL ONE – ELECTION OF DIRECTORS

Proposal One—Election of Directors

The Board is divided into three classes, with each class having a three yearthree-year term. All of the nominees are currently Directors of Principal. We have no reason to believe that any of the Company.nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted at the 2016 Annual Meeting for another person nominated as a substitute by the Board, or the Board may reduce the number of directors.

The Board of Directors recommends that shareholders vote "For" all of the nominees for election at the Annual Meeting.

Nominees for Class III Directors With Terms Expiring in 2016

2019

| | | | ||

| | ||||

|

| | Committees: Human Resources (Chair) Former Public Directorships/Past 5 Mr. Dan was Chairman, President and Chief Executive Officer of The Brink's Company, a global provider of secure transportation and cash management services, from SKILLS AND QUALIFICATIONS: In addition to leading and being responsible for financial management of Brink's, Mr. Dan has He studied business and accounting at Morton College in Cicero, Illinois, and completed the advanced management program at Harvard Business School. | |

| | |||

| | | | ||

| | ||||

| | Committees: Audit, Human Resources, Strategic Issues Dr. Gelatt has been President of NMT Corporation since 1987. NMT is an industry leader in mobile mapping and workforce automation software and has been providing SKILLS AND QUALIFICATIONS: In addition to leading and having financial responsibility for NMT and other Gelatt He earned his bachelor's and master's degrees at the University of Wisconsin and his MA and Ph.D. at Harvard University. | ||

| | ||||

| | | |

| 62016 Proxy Statement | | |

| | | | ||

| | ||||

|

| | Committees: Audit (Chair), Finance, Executive Public Directorships/Past 5 Years: Lexmark International, Inc Former Public Directorships/Past 5 Years: Covance, Inc. Ms. Helton was Executive Vice President and Chief Financial SKILLS AND QUALIFICATIONS: Ms. Helton has global Ms. Helton graduated from the University of Kentucky in 1971 with a B.S. degree in mathematics, summa cum laude, and earned an S.M. degree from Massachusetts Institute of Technology's Sloan School in 1977 with double majors in Finance and Planning & Control. | |

| | ||||

| | | | ||

| | ||||

Blair C. Pickerell | |

Committees: Public Directorships/Past 5 Mr. Mr. Pickerell's current international service includes memberships on the Supervisory Committee for the Tracker Fund of Hong Kong; on the International Advisory Board of the Securities and Exchange Board of India; on the Listing Committee of The Stock Exchange of Hong Kong; and as Director of the Faculty of Business and Economics of The University of Hong Kong. The Nominating and Governance Committee used a search firm to identify and recruit Mr. Pickerell. SKILLS AND QUALIFICATIONS: In addition to his extensive leadership record in the investment and asset management and financial services industries, Mr. Pickerell has executive level experience in the retail consumer, international, marketing, mergers & acquisitions, product development and strategic planning. He is fluent in Mandarin Chinese. He earned a bachelor's degree from Stanford University and an MBA from Harvard Business School. | ||

| | ||||

| | | |

| | | 2016 Proxy Statement7 |

Continuing Class II Directors With Terms Expiring in 2018

| | | |

| | ||

Roger C. Hochschild | | Committees: Strategic Issues (since September 23, 2015) and Audit and Human Resources (effective May 18, 2015) Mr. Hochschild has been SKILLS AND QUALIFICATIONS: Mr. Hochschild has executive level experience in asset and investment management, retail consumer services, executive compensation, financial services, marketing, mergers & acquisitions, product development, risk management and strategic planning. He holds a bachelor's degree in economics from Georgetown University and an M.B.A. from the Amos Tuck School at Dartmouth College. |

| | ||

| | | |

| | ||

Daniel J. Houston | | Former Public Directorships/Past 5 Years: Catalyst Health Solutions, Inc. Mr. Houston has been President and Chief Executive Officer of the Company and Principal Life since

SKILLS AND QUALIFICATIONS: Mr. Houston has operational expertise, global awareness, and deep talent leadership skills. During his career with the Company, he has worked in sales, managed numerous businesses and helped lead the transformation of the Company to a global investment management leader. He Mr. Houston received a bachelor's of science degree |

| | ||

| | | |

| 82016 Proxy Statement | | |

| | | |

| | ||

Elizabeth E. Tallett | | Committees: Human Resources, Nominating and Governance, Executive Public Directorships/Past 5 Years: Meredith Corporation, Qiagen, N. V., Anthem, Inc. Former Public Directorships/Past 5 Years: Coventry Health Care, Inc., Immunicon, Inc., IntegraMed America, Inc., Varian, Inc. and Varian SemiConductor Equipment Associates, Inc. Ms. Tallett has been Lead Director since 2007 and has also served as Alternate Lead Director. She was honored recently with a 2015 Outstanding Director award from the Financial Times. Ms. Tallett was Principal of Hunter Partners, LLC, a management company for early to mid stage pharmaceutical, biotech and medical device companies, from July 2002 to Feb 2015. She continues to operate as a consultant to early stage pharmaceutical and healthcare companies. She has more than 30 years' experience in the biopharmaceutical and consumer industries. SKILLS AND QUALIFICATIONS: Ms. Tallett's senior management experience includes being President and Chief Executive Officer of Transcell Technologies, Inc., President of Centocor Pharmaceuticals, member of the Parke-Davis Executive Committee, and Director of Worldwide Strategic Planning for Warner-Lambert. In addition to her leadership and financial management in pharmaceutical and biotechnology firms, she has executive level experience in multinational companies, international operations, economics, strategic planning, marketing, product development, technology, executive compensation and mergers and acquisitions. She received a bachelor's degree with honors in mathematics and economics from the University of Nottingham in England. |

| | ||

| | | |

Continuing Directors in Class I Directors With Terms Expiring in 2014

2017

| | | | ||

| | ||||

|

| | Committees: Nominating and Governance (Chair), Human Resources (until May 18, 2015), Finance (effective May 18, 2015), Executive Public Directorships/Past 5 Ms. Bernard has been Alternate Lead Director since May 21, 2007. Ms. Bernard was President of AT&T from October 2002 until December 2003 where she led more than 50,000 employees with AT&T Business, then a nearly $27 billion organization serving four million business customers. She was Chief Executive Officer of AT&T Consumer 2001-2002, which served about 40 million consumers and contributed $11.5 billion to AT&T's normalized revenue in 2002. She was head of the consumer and SKILLS AND QUALIFICATIONS: In addition to leading and being responsible for financial management of AT&T, Ms. Bernard has She earned her bachelor's degree from St. Lawrence University, a master's degree in business administration from Fairleigh Dickinson University, and an MA from Stanford University in the Sloan Fellow Program. | |

| | ||||

| | | |

| |  | 2016 Proxy Statement9 |

| | | |

| | ||

| | Committees: Finance (Chair), Nominating and Governance Public Directorships/Past 5 Ms. Carter-Miller has been President of TechEd Ventures since 2005, SKILLS AND QUALIFICATIONS: In addition to her marketing leadership background, Ms. Carter-Miller has She earned her B.S. in Accounting at the University of Illinois and an MBA in Finance and Marketing at the University of Chicago. |

| | ||

| | |

| | ||

Dennis H. Ferro | |

Committees: Audit, Finance, Strategic Issues Former Public Directorships/Past 5

|

|

Mr. Ferro served as President and Chief Executive Officer of Evergreen Investment Management Company, an asset management firm, from 2003 to 2008. Evergreen had assets under management of $175 billion on December 31, 2008, served more than four million individual and institutional investors through management of a broad range of investment products including institutional portfolios, mutual funds, variable annuities and other investments, and was led by 300 investment professionals. Mr. Ferro was the Chief Investment Officer of Evergreen from 1999 to 2003. From 1994-1999, he was Executive Vice President of Zurich Investment Management Ltd. and Head of International Equity Investments, and from 1991-1994 was Senior Managing Director of CIGNA International Investments. Prior to 1991, he held positions with Bankers Trust Company in Japan, as President and Managing Director, and in Florida and New York. Mr. Ferro is a member of the Investment Committee of the American Bankers Association. During SKILLS AND QUALIFICATIONS: In addition to leading and being responsible for financial management of Evergreen Investment Management Company, Mr. Ferro has He earned a bachelor's degree from Villanova University and an MBA in finance from St. John's University. Mr. Ferro is a Chartered Financial Analyst ("CFA"). |

Continuing Class II Directors With Terms Expiring in 2015

| | ||

| | |

| 102016 Proxy Statement |  |

| |

|

|

|

|

The Board of Directors recommends that shareholders vote "For" all of the nominees for election at the Annual Meeting.

PROPOSAL TWO – ANNUAL ELECTION OF DIRECTORS

Corporate Governance

The Company's Board and management regularly review best practices for corporate governance and modify our policies and practices as warranted. Our current best practices include:

The Certificate of Incorporation is the governing document that describes how the Company is organized under Delaware law. The Certificate of Incorporation requires that the Directors be divided into three classes of approximately equal size, and that the classes of Directors be elected to serve staggered three-year terms. This is commonly referred to as a "classified board" structure, with only a portion of the full board standing for election each year.

The Company adopted a classified board structure as part of our Demutualization and initial public offering in 2001. The Board of Directors recognized the advantagesevent of a classified board structurelack of majority shareholder support;

The Nominating and Governance Committee and the Board regularly look at the Company's corporate governance practices for continued effectiveness in the current environment. The Committee and the Board undertook a careful review of the classified board structure, including the often cited disadvantage that it does not afford shareholders the opportunity to evaluate and hold directors accountable on an annual basis. The Nominating and Governance Committee and the Board recognized that there are both advantages and disadvantages to a classified board structure, that corporate governance trends indicate companies are moving away from classified boards and that the Principal Financial Group is committed to good corporate governance.

The Board of Directors submitted a proposal for the annual election of Directors to be voted on at the 2011 Annual Meeting. The proposal did not receive the required approval of at least three-fourths of the outstanding shares, as required by the Certificate of Incorporation, and was not adopted. The Board's 2011 proposal provided that all current Directors would serve one more three-year term, then all Directors would be elected annually thereafter. If it had been approved by shareholders, the 2011 proposal would have resulted in all Directors being elected annually by 2016. Now, the Board is submitting a new proposal for the annual election of Directors which, if approved by shareholders, would also result in the annual election of all Directors by 2016. In addition, if the proposal is approved, a majority of the positions on the Board of Directors would be subject to election to one year terms at the 2015 Annual Meeting.

The Board of Directors recommends the amendments to the Company's Certificate of Incorporation set forth in Appendix A to fully implement the annual election of Directors by 2016. If these amendments are approved at the Annual Meeting, the declassified Board structure would be phased-in as follows: The Class III Directors elected at this Annual Meeting will be elected for three-year terms, the Class II Directors elected at the 2012 Annual Meeting will complete their current three-year terms, and the Class I Directors elected in 2014 and all Directors elected thereafter will be elected for one-year terms. This results in the annual election of all Directors by 2016. In addition, in accordance with Delaware law and once the annual election of Directors is fully implemented under the Board's proposal, Directors may be removed by the vote of shareholders with or without cause.

Delaware law provides that the shareholders must approve this recommendation of the Board of Directors to amend the Certificate of Incorporation before the amendments and these changes can be effective. The Certificate of Incorporation requires that at least three-fourths of the outstanding shares entitled to vote on this proposal approve the proposal for it to be adopted. If approved by the shareholders, the amendments to the Certificate of Incorporation will be effective upon filing with the Delaware Secretary of State, the Board of Directors will make conforming changes to the Company's By-Laws and the annual election of Directors will be implemented on a phased-in basis as described in this proposal.

The Board of Directors recommends that the shareholders vote "For" this resolution: RESOLVED, that the Company's Certificate of Incorporation be amended as set forth in Appendix A.

CORPORATE GOVERNANCE

Board Leadership Structure

The Principal Financial Group® is a global investment management leader offering businesses, individuals and institutional clients a wide range of financial products and services, including retirement services, insurance solutions and asset management. The business of the Company is managed under the direction of the Board. The Board selects,believes it should have the flexibility to establish a leadership structure that works best for Principal at any given time and provides advice and counsel to,reviews that structure as appropriate. Historically, the Chief Executive Officer ("CEO") and generally oversees management. The Board reviews and discusses the strategic direction of the Company, oversees risk and monitors the Company's performance against goals the Board and management establish.

Board Leadership Structure

The Board currently has a combined positionpositions of Chairman of the Board and CEO have been separately held by two people or combined and held by one person, depending on prevailing circumstances. Currently, these roles are separate: Larry D. Zimpleman and a Presiding Director, Elizabeth E. Tallett. Betsy J. Bernard is the Alternate Presiding Director. The PresidingChairman of the Board, and Dan Houston is the CEO. Effective immediately following the annual meeting, Mr. Houston will be both Chairman of the Board and CEO. Since 1990, the Board has appointed a Lead Director because it is selected byimportant that the other independent Directors andhave a formally acknowledged leader in addition to the position does not automatically rotate. The Nominating and Governance Committee reviewsChairman of the assignments as Presiding Director and Alternate Presiding Director annually.Board who leads the Board generally. The Board regularly reviews its leadership model and is flexible aboutthe effectiveness of this shared leadership. The decision of whether the positions of CEO and Chairman should beto separate or combined. The decisioncombine the Chair and CEO positions is based on factors such as the tenure and experience of the CEO and the broader economic and operating environment of the Company. The Company hasAs was the case during the past year, Principal followed a pattern of separating the roles of Chairman of the Board and CEO during periods of management transition, with the prior Chairman retaining that position for a period of time as the newly-appointednewly appointed CEO assumes new responsibilities as the Company's chief executive. In the Company's experience, a flexible approach is preferable to an approach that either requires or disallows a combined Chairman/CEO.

Ms. Tallett is the Lead Director and Ms. Bernard is the Alternate Lead Director.

The PresidingLead Director and Alternative Lead Director are selected by the independent Directors. The Nominating and Governance Committee reviews the assignments of Lead Director and Alternate Lead Director annually.

The Lead Director and the Chairman jointly make the decisions on the Board's agenda for each regular quarterly meeting, and the PresidingLead Director seeks input from the other independent Directors. The PresidingLead Director and Chairman share the duties of presiding at each Board meeting. The Chairman presides when the Board is meeting as a full Board. The PresidingLead Director:

| | | 2016 Proxy Statement11 |

Role of the Board in Risk Oversight

Risk management is an essential component of our culture and business model. Management within our business units and functional areas is primarily responsible for identifying, assessing, monitoring and managing risk exposures. The Company's Enterprise Risk Management program includes a Chief Risk Officer, whose team operates independently from the business units, and an Enterprise Risk Management Committee, comprised of members from the executive management team, that provides enterprise wide oversight for material risks. The Company also has a robust internal audit function.

The Board believes that risk oversight is a responsibility of the full Board. The Board weighs risk versus return in the context of the organization's key risksoversees management's execution and risk philosophy when approving corporate strategy and major business decisions, setting executive compensation and monitoring the Company's progress. Like all financial services companies, we are exposed to financial, accounting, operational and other business and industry risks. The Board uses its committees for someperformance of its risk oversight responsibilitiesmanagement responsibilities. The Board reviews strategic threats, opportunities, and the committees report torisks Principal and particular businesses or functions are managing. Oversight of other risks such as credit, market, liquidity, product, operational, cybersecurity and general business risk, is handled directly by the Board on these issues:or by Board Committees as discussed below:

The Audit Committee:

Table of Contentsmanagement.

The Finance Committee:

The Human Resources Committee reviews all incentive: risk and mitigation related to the design and operation of employee compensation arrangements to confirm that they are consistent with business plans, do not encourage inappropriate risk-takingrisk taking and are appropriately designed to limit or mitigate risk. The Human Resources Committee also oversees succession planning and development for senior management.

In selecting candidates forThe Nominating and Governance Committee: risks and mitigation related to the Board,Company's environmental, sustainability and corporate social responsibilities as well as the Company's political contribution activities. The Nominating and Governance Committee takes into accountalso monitors the need for the Board and its committees to have the collective skills and experience necessary to monitor the risks facing the Company.Principal.

Risk management has long been an essential component of the Company's culture and operations. The Company has had a Chief Risk Officer since 2005, who oversees and coordinates the ERM Program, serves on many key management committees and operates independently of the businesses. The Chief Risk Officer regularly attends Audit and Finance Committee meetings and regularly meets in executive session with the Audit Committee along with selected other members of management and without other members of management present at least once a year.

The Chief Risk Officer and other members of senior management make periodicprovide reports to and have discussions with the Board and its committees on the ERM Program,our risk profile and risk management activities. Discussions include reviews of ongoing adherence to policy, impacts of external events, and how strategy, initiatives, and operational initiativesoperations integrate with the Company'sour risk objectives. The Board also receives perspectives from external entities such as our independent auditor, regulators, and consultants. These reportspresentations and discussions provide the Board with a greater understanding of the material risks the organization faces, whether management is responding appropriately, how certain risks relate to other risks, and the level of risk in actions presented for Board approval.approval, how certain risks relate to other risks, and whether management is responding appropriately,

Capital adequacyDuring 2015, the Board deepened its emphasis on cybersecurity risk and structure areour information security program. The Board views this risk as an important focus ofenterprise wide concern that involves people, process, and technology, and accordingly treats it as a Board level matter. It embodies a persistent and dynamic threat to our entire industry that is not limited to information technology. The Board will remain focused on this critical priority by continuing to receive regular reports from the ERM Program. For each regular Board meeting, management reports on sourcesChief Information Officer and uses of capital, satisfaction of regulatoryothers to ensure that it is monitoring cyber threat intelligence and rating agency capital requirements, excess capital position, capital managementtaking the steps necessary to implement the needed safeguards and liquidity.protocols to manage the risk.

Majority Voting

Succession Planning and Talent Development

The Board believes that succession planning for future leadership of the Company is one of its most important roles. The Board is actively engaged and involved in talent management and reviews succession at least annually. This includes a detailed discussion of our global leadership and succession plans with a focus on key positions at the levels of senior vice president and above. In addition, the Human Resources Committee regularly discusses the talent pipeline for critical roles at a variety of organizational levels. High potential leaders are given exposure and visibility to Board members through formal presentations and informal events and the Committee also receives regular updates on key talent indicators for the overall workforce, including diversity, recruiting and development programs.

In uncontested Director elections, Directors are elected by the majority of votes cast in uncontested Director elections.cast. If an incumbent Director is not elected and no successor is elected, the Director must submit a resignation to the Board of Directors, which will

| 122016 Proxy Statement | | |

decide whether to accept the resignation tendered by that incumbent Director.resignation. The Board's decision and reasons forin support of its decision will be publicly disclosed within 90 days of certification of the election results.

Director Independence

The Board determines at least annually whether each Director is independent, using its independence standards in these determinations. These independence standards include the New York Stock Exchange requirements for independence and are on the Company's website,www.principal.com. www.principal.com. The Board considers all commercial, banking, consulting, legal, accounting, charitable, family and other relationships (as(either individually or as a partner, shareholder or officer of an organization) a Director may have with the Company and its subsidiaries. The Board most recently made these determinations for each Director in February 2013,2016, based on:

The Board affirmatively determined that the following Directors (and Arjun Mathrani who served on the Board during 2012) have no material relationship with the Company and are independent: Ms. Bernard, Ms. Carter-Miller, Dr. Costley, Mr. Dan, Mr. Ferro, Dr. Gelatt, Ms. Helton, Mr. Keyser,Hochschild, Mr. MaestriPickerell and Ms. Tallett. The Board also determined that all current members (and Directors who were members in 2012) of the Audit, Finance, Human Resources and Nominating and Governance Committees are independent.

In applying the Board's independence standards, the Nominating and Governance Committee and the Board considered the followingSome Directors have categorically immaterial relationships and transactions to be categorically immaterial to the determination of a Director's independence due to the nature of the transaction and the amount involved (in each of the transactions described below, the annual payments made or received by the Company did not exceed the greater of $1 million or 2 percent of the recipient's gross revenues):with Principal:

Certain Relationships and Related Party Transactions

Nippon Life Insurance Company ("Nippon Life"), which held approximately 6%6.2% of the Company's Common Stock at the end of 2012,2015, is the parent company of Nippon Life Insurance Company of America ("NLICA"). Nippon Life, NLICA and Principal Life have had an ongoinga business relationship for more than 20 years. Principal Life assisted Nippon Life in the start up activities of NLICA, which began business in 1991.In 2015, Nippon Life and NLICA purchase retirement and financial services offered bypaid the following amounts to Principal Life or its subsidiaries and its subsidiaries.affiliates: $91,670.69 for pension services for defined contribution plans maintained by NLICA and an affiliate (mostly paid Principal Life approximately $10 millionby plan participants); $1,250 for third party administration services related to its group welfare benefit plans and approximately $3,242deferred compensation plan services; $757,246.30 for wellness services during 2012. Nippon Life and NLICA also paidinvestment services;. Principal Global Investors LLC ("PGI") and its subsidiaries approximately $920,597(Japan) Ltd. paid Nippon Life $2,607.00 for investment services in 2012, and paid Principal Life approximately $206,114 for service related to its retirement plans in 2012.401(k) plan administration. The Company owns approximately three percent of the common stock of NLICA and Principal Life purchased public bonds with a market value at the end of $52,814,1502015 of $62,700,000 during Nippon Life's $2 billion public issuance in October of 2012.

The Company announced on April Since May 1, 2013, an agreement by its subsidiary, PGI, to sell a 20 percent stake inNLI US Investments, Inc. ("NLI"), has owned 20% of Post Advisory Group, LLC ("Post"), an affiliate of the Company. During 2015, Post paid NLI an aggregate of $2,724,846.71 in dividends.

During 2015, Principal Management Corporation, an affiliate of the Company ("PMC"), paid Wellington Management Company $3,990,303.76 for sub-advisory services furnished to Nippon Life and its affiliate fora registered investment company managed by PMC. As of the end of 2015 Wellington owned approximately $38 million. PGI acquired Post in 2003 and will retain an 80 percent ownership6.5% of the Company's Common Stock.

As of December 31, 2015, the Vanguard Group, Inc. managed funds holding in the business moving forward. Post is an investment manageraggregate 8.3% of high yield fixed income securities with approximately $11.8 billionthe Company's Common Stock. During 2015 Principal Shareholder Services, Inc. paid Vanguard $88,427.27 for sub-transfer agent services. Vanguard paid $1,059,786 in assets under management asrent for lease of March 27, 2013. The transaction is expectedspace to enhance Nippon Life's fixed income investment management offering to its clients and bring new distribution opportunities for Post. Post's management will continue to direct its day-to-day operations, with continued autonomya borrower of investment decisions. The transaction is expected to close in the second quarterPrincipal Life Insurance Company general account.

| | | 2016 Proxy Statement13 |

The Nominating and Governance Committee or its Chair of the Committee must approve or ratify all transactions with Related Parties that are not pre-approvedpreapproved under the Company's Related Party Transaction Policy. At each quarterly meeting, the Committee reviews a report of any non-materialnonmaterial transactions with Directors or the firms of which they are an executive officer or director, and any other Related Party transactions, including those involving executive officers and shareholders who own more than five percent of the Company's Common Stock.Parties. The Committee ratifies these transactions if it determines they are appropriate. Transactions involving employment of a relative of an executive officer or Director must be approved by the Human Resources Committee. The Company's Related Party Transaction Policy may be found atwww.principal.com. www.principal.com.

Board Meetings

The Board held 1110 meetings in 2012,2015, five of which were two day, in person meetings. Each of the Directors then in office attended more than 75 percent75% in the aggregate of the meetings of the Board and the committees of which the Director was a member.member except Richard L. Keyser and Luca Maestri who left the board in May of 2015. All of the other Directors then in officeon the Board attended the 20122015 Annual Meeting, with the exception of Arjun Mathrani whose retirement from the Board was effective at the time of the Annual Meeting. The Company sets the date and place of Annual Meetings to coincide with a regular Board meeting so that all Directors can attend.

Corporate Code of Business Conduct and Ethics

Each Director and officer of the Company has certified compliance with the CorporateGlobal Code of Business Conduct and Ethics.Ethics, which serves as the foundation for ethical behavior across the organization. The Code is available at www.principal.com.

Board Committees

Only independent Directors may serve on the Audit, Human Resources and Nominating and Governance Committees. Committee members and Committee chairs are recommended to the Board by the Nominating and Governance Committee. The Committees review their charters and evaluate their performance annually. Committee charters of the Audit, Finance, Human Resources and Nominating and Governance Committees are available on the Company's website, www.principal.com.

| 142016 Proxy Statement | | |

www.principal.com.Table of Contents

The following table shows the currentCurrent membership and responsibilities of each of the Board Committees.Committees:

| Committee | | Responsibilities | | Members (*Committee Chair) | | Meetings Held in | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | ||||||||||

| Audit | | • Appointing, terminating, compensating and overseeing the Company's independent • Reviewing and reporting to the Board on the independent auditor's activities; • Approving all audit engagement fees and • Reviewing internal audit plans and results; • Reviewing and reporting to the Board on accounting policies and legal and regulatory compliance; and • Reviewing the Company's policies on risk assessment and management. All members of the Audit Committee are financially literate and are independent, as defined in the New York Stock Exchange listing standards, and Ms. Helton is a financial expert, as defined by the Sarbanes-Oxley Act. | | Gary E. Costley(9) Dennis H. Ferro C. Daniel Gelatt Sandra L. Helton* Roger C. Hochschild(1) | | 9 | ||||||||||

| | | | | | | | ||||||||||

| Human Resources | | • Evaluating the performance of the CEO and determining his compensation • Approving compensation for all other officers of the Company and Principal Life at the level of Senior Vice President and above officers ("Executives"); • Approving employment, severance or change of control agreements and perquisites for Executives; • Overseeing Executive development and succession planning; • Approving salary and employee compensation policies for all other employees; • Administering the Company's • Acting on management's recommendations • Reviewing compensation programs to confirm that | | Betsy J. Bernard(2) Gary E. Costley(1,9) Michael T. Dan* C. Daniel Gelatt Roger C. Hochschild(1) Elizabeth E. Tallett | | 6 | ||||||||||

| | | | | | | | ||||||||||

| Nominating and Governance | | • Recommends Board candidates, Board committee assignments and service as Lead and Alternate Lead Director; • Reviews and reports to the Board on Director independence, performance of individual Directors, process for the annual self evaluations of the Board and its performance and committee self evaluations, content of the Global Code of Business Conduct and Ethics, Director compensation, and the Corporate Governance Guidelines; • Reviews environmental and corporate social responsibility matters as well as the Company's political contribution activities. | | Betsy J. Bernard* Jocelyn Carter-Miller Michael T. Dan(1) Blair C. Pickerell(3) Elizabeth E. Tallett | | 5 | ||||||||||

| | | | | | | |

| | | 2016 Proxy Statement15 |

| Committee | | Responsibilities | | Members (*Committee Chair) | | Meetings Held in | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | |||||||||||

| Finance | | • Assists the Board with • Reviews capital structure and • Oversees investment policies, strategies and | ||||||||||||||

| | Betsy J. Bernard(1) Jocelyn Carter-Miller* Gary E. Costley(2) Dennis H. Ferro Blair Pickerell(3) | | 8 | |||||||||||||

| | | | | | ||||||||||||

| Strategic Issues | | Plans the | | Gary E. Costley(8) Dennis H. Ferro*(5) C. Daniel Gelatt*(6) Roger C. Hochschild(7) Blair C. Pickerell(7) | | 4 | ||||||||||

| | | | | | | | ||||||||||

| Executive | | | Betsy J. Bernard Sandra L. Helton Daniel J. Houston(4) Elizabeth E. Tallett Larry D. Zimpleman(9)* | | None | |||||||||||

| | | | | | | |

| 162016 Proxy Statement | | |

Directors serve on the Boards of the Company, Principal Life and Principal Financial Services, Inc. Directors who are also employees do not receive any compensation for their service as Directors. The Company provides competitive compensation to attract and retain high quality Directors. A substantial proportion of Director compensation is provided in the form of equity to help align Directors' interests with the interests of shareholders.

The Director compensation program is reviewed annually. The Nominating and Governance Committee uses the Board's independent compensation consultant, Frederic W. Cook & Co., Inc. ("Cook") to conduct a comprehensive review and assessment of Director compensation. Cook last reviewed Director compensation in November of 2015. The Company targets Director compensation at approximately the median of the peer group used for Executive compensation comparisons ("Peer Group") (see page 26), which aligns with its Executive compensation philosophy. As a result of that review and the Committee's discussion, no changes were made to the Board compensation program, except with respect to the nonexecutive Chairman, as detailed below.

| | | |

| | Effective Since January 1, 2015 | |

| | | |

| Annual Cash Retainers(1) | | |

| | | |

| - Board | | $95,000 |

| | | |

| - Audit Committee Chair | | $20,000 |

| | | |

| - Human Resources Committee Chair | | $17,500 |

| | | |

| - Finance Committee Chair | | $15,000 |

| | | |

| - Nominating & Governance Committee Chair | | $15,000 |

| | | |

| - Other Committee Chairs | | $5,000 |

| | | |

| - Lead Director | | $25,000 |

| | | |

| Annual Restricted Stock Unit Retainer(2) | | |

| | | |

| - Board | | $130,000 |

| | | |

| Meeting Attendance Fees | | |

| | | |

| - Regularly Scheduled Board Meeting | | No meeting fees |

| | | |

| - Non-regularly Scheduled Board Meetings (in person) | | $2,500 per day |

| | | |

| - Non-regularly Scheduled Board Meetings (Telephonic) | | $1,000 |

| | | |

| - Committee Meeting | | $1,500 |

| | | |

| - Telephonic Committee Meeting | | $1,000 |

| | | |

Effective January 4, 2016, Mr. Zimpleman became a non executive Chairman of the Board, and he will be paid an annual retainer of $200,000 for this service, in addition to the normal compensation provided to non-employee members of the Board, both prorated for the period January 1 - May 17, 2016.

| | | 2016 Proxy Statement17 |

Fees Earned by Directors in 2015

| | | | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |||||

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total | | |||||

| | | | | | | | | |||||

| Betsy J. Bernard | | | $ | 132,000 | | | $ | 129,990 | | $ | 261,990 | |

| | | | | | | | | |||||

| Jocelyn Carter-Miller | | | $ | 133,000 | | | $ | 129,990 | | $ | 262,990 | |

| | | | | | | | | |||||

| Gary E. Costley | | | $ | 119,000 | | | $ | 129,990 | | $ | 248,990 | |

| | | | | | | | | |||||

| Michael T. Dan | | | $ | 130,000 | | | $ | 129,990 | | $ | 259,990 | |

| | | | | | | | | |||||

| Dennis H. Ferro | | | $ | 127,500 | | | $ | 129,990 | | $ | 257,490 | |

| | | | | | | | | |||||

| C. Daniel Gelatt Jr. | | | $ | 123,500 | | | $ | 129,990 | | $ | 253,490 | |

| | | | | | | | | |||||

| Sandra L. Helton | | | $ | 142,000 | | | $ | 129,990 | | $ | 271,990 | |

| | | | | | | | | |||||

| Roger C. Hochschild | | | $ | 126,943 | | | $ | 145,143 | | $ | 272,086 | |

| | | | | | | | | |||||

| Richard L. Keyser | | | $ | 6,000 | | | $ | 0 | | $ | 6,000 | |

| | | | | | | | | |||||

| Luca Maestri | | | $ | 6,000 | | | $ | 0 | | $ | 6,000 | |

| | | | | | | | | |||||

| Blair C. Pickerell | | | $ | 83,189 | | | $ | 97,866 | | $ | 181,055 | |

| | | | | | | | | |||||

| Elizabeth E. Tallett | | | $ | 139,000 | | | $ | 129,990 | | $ | 268,990 | |

| | | | | | | | | |||||

Directors' Deferred Compensation Plan

Directors may defer the receipt of their cash compensation under the Deferred Compensation Plan for Non-Employee Directors of Principal Financial Group, Inc. This Plan has four investment options:

All of these funds are available to participants in Principal Life's Excess Plan. The returns realized on these funds during 2015 are listed in the table, "Qualified 401(k) Plan and Excess Plan," on pages 44-45.

Directors receive an annual grant of Restricted Stock Units ("RSUs"). The grant made in 2015 was made under the Principal Financial Group, Inc. 2014 Directors Stock Plan. RSUs are granted at the time of the annual meeting, vest at the next annual meeting and are deferred until at least the date the Director leaves the Board. At payout, the RSUs are converted to shares of Common Stock. Dividend equivalents become additional RSUs, which vest and are converted to Common Stock at the same time and to the same extent as the underlying RSU. The Nominating and Governance Committee has the discretion to make a prorated grant of RSUs to Directors who join the Board at a time other than at the annual meeting. While the 2014 Director Stock Plan (which was approved by shareholders) affords some discretion in determining the dollar value of RSUs that may annually be awarded to each non-employee Director, it imposes a maximum limit of $230,000 ($500,000 for an Independent Chairman) on the size of the annual award that may be made to any non-employee Directors.

| 182016 Proxy Statement | | |

As of December 31, 2015, each Director had the following aggregate number of outstanding RSUs as a result of Director compensation in 2015 and prior years, including additional RSUs as the result of dividend equivalents:

| | ||

|---|---|---|

| | | |

| Director Name | | Total RSUs Outstanding Fiscal Year End 2015 (Shares) |

| | | |

Betsy J. Bernard | | 34,373 |

| | | |

Jocelyn Carter-Miller | | 36,345 |

| | | |

Gary E. Costley | | 34,373 |

| | | |

Michael T. Dan | | 31,913 |

| | | |

Dennis H. Ferro | | 19,397 |

| | | |

C. Daniel Gelatt | | 39,139 |

| | | |

Sandra L. Helton | | 34,373 |

| | | |

Roger C. Hochschild | | 2,839 |

| | | |

Richard L. Keyser | | 0 |

| | | |

Luca Maestri | | 0 |

| | | |

Blair C. Pickerell | | 1,725 |

| | | |

Elizabeth E. Tallett | | 38,651 |

| | | |

Principal Life matches charitable gifts up to an annual amount of $16,000 per nonemployee Director. These matching contributions are available during a Director's term and the following three years. Principal Life receives the charitable contribution tax deductions for the matching gifts.

Directors are reimbursed for travel and other business expenses they incur while performing services for the Company. Directors' spouses/partners may accompany them to the annual Board strategic retreat. Principal pays for some of the travel expenses and amenities for Directors and their spouses/partners, such as meals and social events. Directors are also covered under the Company's Business Travel Accident Insurance Policy and Directors' and Officers' insurance coverage. In 2015 the total amount of perquisites provided to nonemployee Directors was less than $10,000 in all cases.

Directors' Stock Ownership Guidelines

To encourage Directors to accumulate a meaningful ownership level in the Company, the Board has had a "hold until retirement" stock ownership requirement since 2005. All RSU grants must be held through a Director's service on the Board, and may only be converted to Common Stock when the Director's Board service ends. The Board has a guideline that Directors own interests in Common Stock equal to five times the annual Board cash retainer within five years of joining the Board. Directors have been able to achieve this level of ownership through the RSU hold until retirement requirement. Once this guideline is met, Directors will not need to make additional share purchases if the guideline is no longer met due to a reduction in stock price, as long as the Director's ownership level is not reduced as a result of share sales.

The Audit Committee oversees the Company's financial reporting process. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Committee reviewed with management the audited financial statements for the fiscal year ended December 31, 2012, including a discussion of2015, and discussed the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Committee discussed with Ernst & Young LLP, the Company's independent auditor, the matters required to be discussed by Statement on Auditing Standards ("SAS") 114,The Auditor's Communication with

those Charged with Governance,, as adopted by the Public Company Accounting Oversight Board (United States) ("PCAOB") in Rule 3200T. SAS 114 requires the independent auditor to communicate (i) the auditor's responsibility under standards of the PCAOB; (ii) an overview of the planned scope and timing of the audit; and (iii) significant findings from the audit, including the qualitative aspects of the entity's significant accounting practices;practices, significant difficulties, if any, encountered in performing the audit;audit, uncorrected misstatements identified during the audit,

| | | 2016 Proxy Statement19 |

other than those the auditor believes are trivial, if any;any, any disagreements with management;management, and any other issues arising from the audit that are significant or relevant to those charged with governance.

The Committee received from Ernst & Young LLP the written disclosures and letter required by applicable requirements of the PCAOB regarding the independent auditor's communications with the Committee concerning independence. The Committee has discussed with Ernst & Young LLP its independence and Ernst & Young LLP has confirmed in its letter that, in its professional judgment, it is independent of the Company within the meaning of the federal securities laws.

The Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board (and the Board approved) that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2012,2015, for filing with the SEC. The Committee has also approved, subject to shareholder ratification, the appointment of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2013.2016.

The Committee does not have the responsibility to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of the Company's independent auditor and management. In giving our recommendation to the Board, the Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of the Company's independent auditor with respect to such financial statements.

Sandra L. Helton, Chair

Gary E. Costley

Dennis H. Ferro

C. Daniel GelattLuca MaestriRoger C. Hochschild

| 202016 Proxy Statement | | |

Director Qualifications, Process for Identifying and Evaluating Director Candidates and Diversity of the Board

The Committee regularly assesses the appropriate mix of skills and characteristics of Directors in light of the current make up of the Board and the Company's needs. The Committee periodically uses an outside consultant to help the Committee evaluate the expertise, backgrounds and competencies of the Directors in view of the current strategic initiatives and risk factors of the Company. The results of these assessments provide direction in searches for Board candidates.

Individual performance reviews are conducted for Directors who are eligible for re-nomination at the next annual meeting. These reviews assess Directors' contributions, present occupation and other commitments. The Committee has used outside firms to assist the Committee with these Director evaluations.

In Director and candidate evaluations, the Committee assesses personal and professional ethics, integrity, values, expertise and ability to contribute to the Board. The Board values experience as a current or former CEO or other senior executive, in financial services, in international business and with financial management or accounting responsibilities. The following competencies are also sought: strategic orientation,

results-orientation and comprehensive decision-making. Directors' terms must end prior to the annual meeting following their 72nd birthday.

All Board members have:

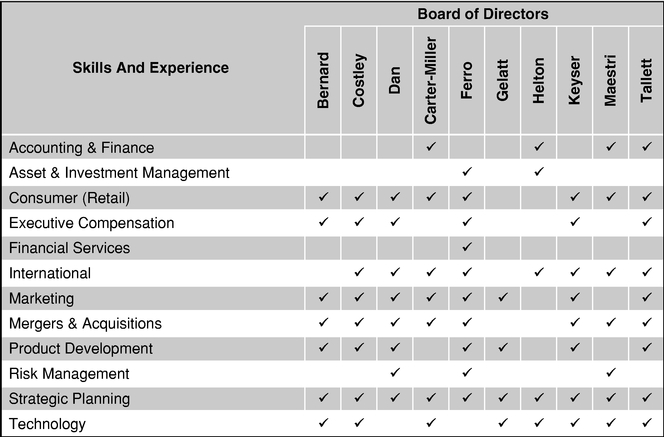

Several Directors have led businesses or major business divisions as CEO or President (Ms. Bernard, Dr. Costley, Mr. Dan, Mr. Ferro, Dr. Gelatt, Mr. Keyser, Mr. Maestri and Ms. Tallett). The following chart shows areas central to the Company's strategy, initiatives and operations for which Directors have specific training and executive-level experience that assists them in their responsibilities.

Diversity of the Board is a valued objective. The Nominating and Governance Committee reviews the Board's needs and diversity in terms of race, gender, national origin, backgrounds, experiences and areas of expertise. The Board recognizes that diversity is an important factor in Board effectiveness, which is apparent by the Board's selection of Directors. The Board does not have a formal diversity policy. The Company's culture and commitment to diversity has been recognized by organizations such as the National Association of Female Executives, the Human Rights Campaign Corporate Equality Index, 2020 Women on Boards campaign and LATINAStyle magazine. The Board's effectiveness benefits from Directors who have the skills, backgrounds and qualifications needed by the Board and who also increase the Board's diversity.

The Committee will consider shareholder recommendations for Director candidates sent to the Nominating and Governance Committee, c/o the Corporate Secretary. Director candidates nominated by shareholders are evaluated in the same manner as Director candidates identified by the Committee and search firms it retains.

DIRECTORS' COMPENSATION

Directors serve on the Boards of the Company, Principal Life and Principal Financial Services, Inc. Directors who are also employees do not receive any compensation for their service as Directors. The Company provides competitive compensation to attract and retain high-quality Directors. A substantial proportion of Director compensation is provided in the form of equity to help align Directors' interests with the interests of shareholders.

The Director compensation program is reviewed annually. The Nominating and Governance Committee uses the Board's independent compensation consultant, Frederic W. Cook & Co., Inc. ("Cook") to conduct a comprehensive review and assessment of Director compensation. Cook reviewed Director compensation in August of 2012. As a result of that review and the Committee's discussion, the Committee recommended to the Board that no changes be made to the program at that time. The Board last changed the Director compensation program in November of 2011. The Company targets Director compensation at approximately the median of the Peer Group (see page 33), which aligns with its Executive compensation philosophy.

The following chart shows the Director fees effective January 1, 2012 which remain in effect:

Fees Earned by Directors in 2012

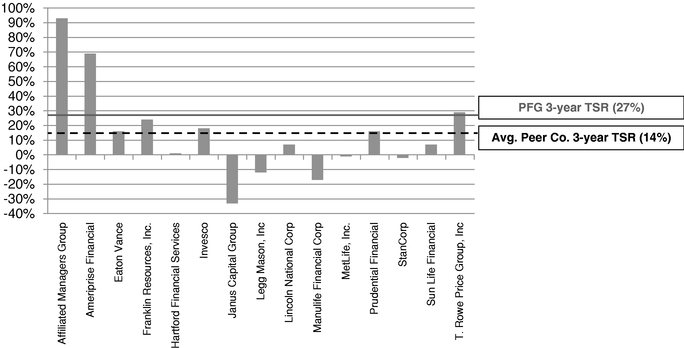

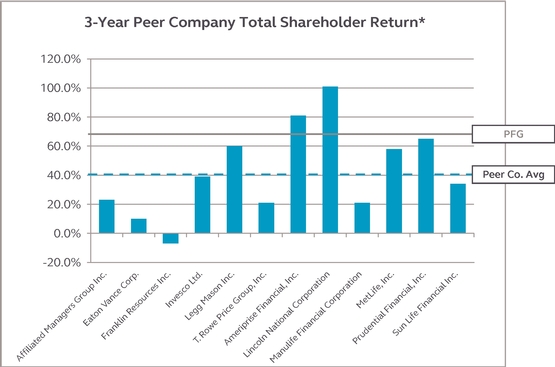

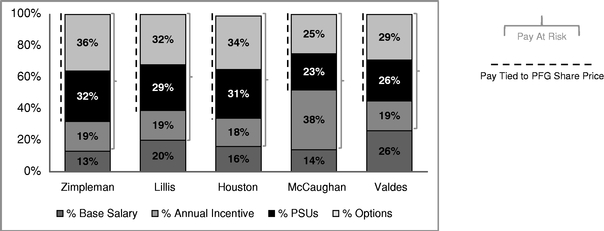

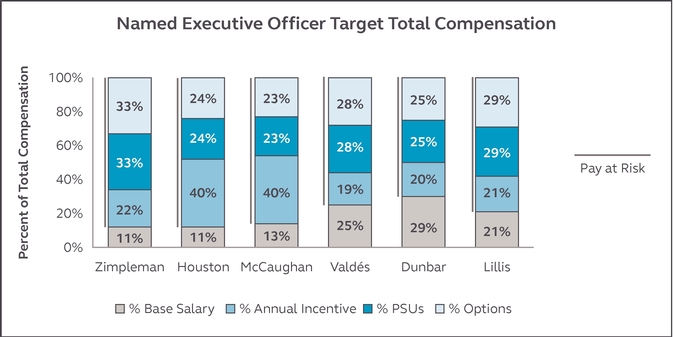

The following table summarizes the compensation earned by Directors in 2012.